HDB new rules on CPF usage and HDB housing loans (wef 10 May 2019)

Currently, the amount of CPF to be used for the purchase of a property is dependent on the remaining lease of the property.

>> If lease is at least 60 years remaining, a buyer can use the maximum CPF allowed to pay for the property.

>> If lease is less than 60 years remaining, a buyer is eligible to use CPF if his age plus the remaining lease is at least 80 years.

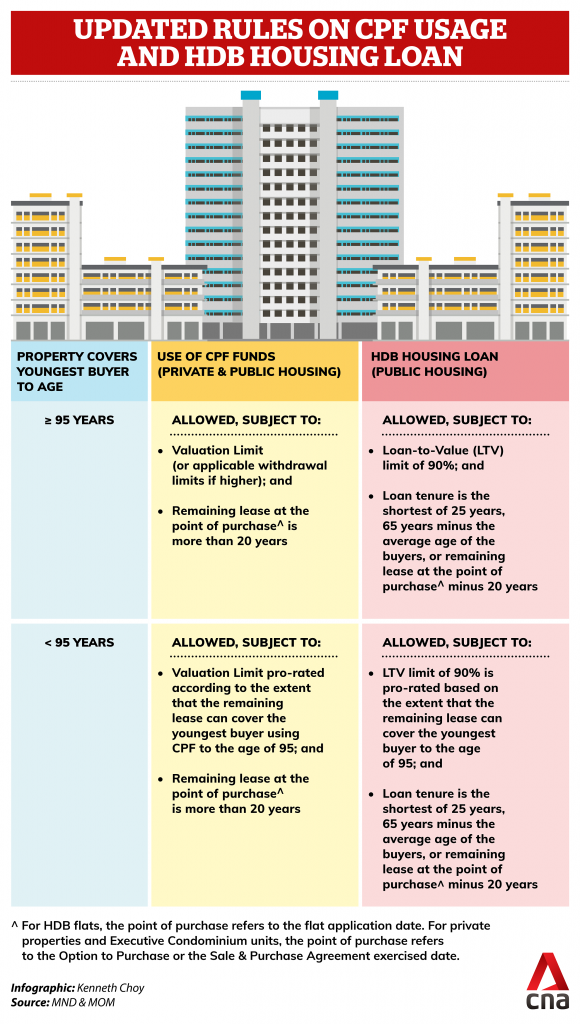

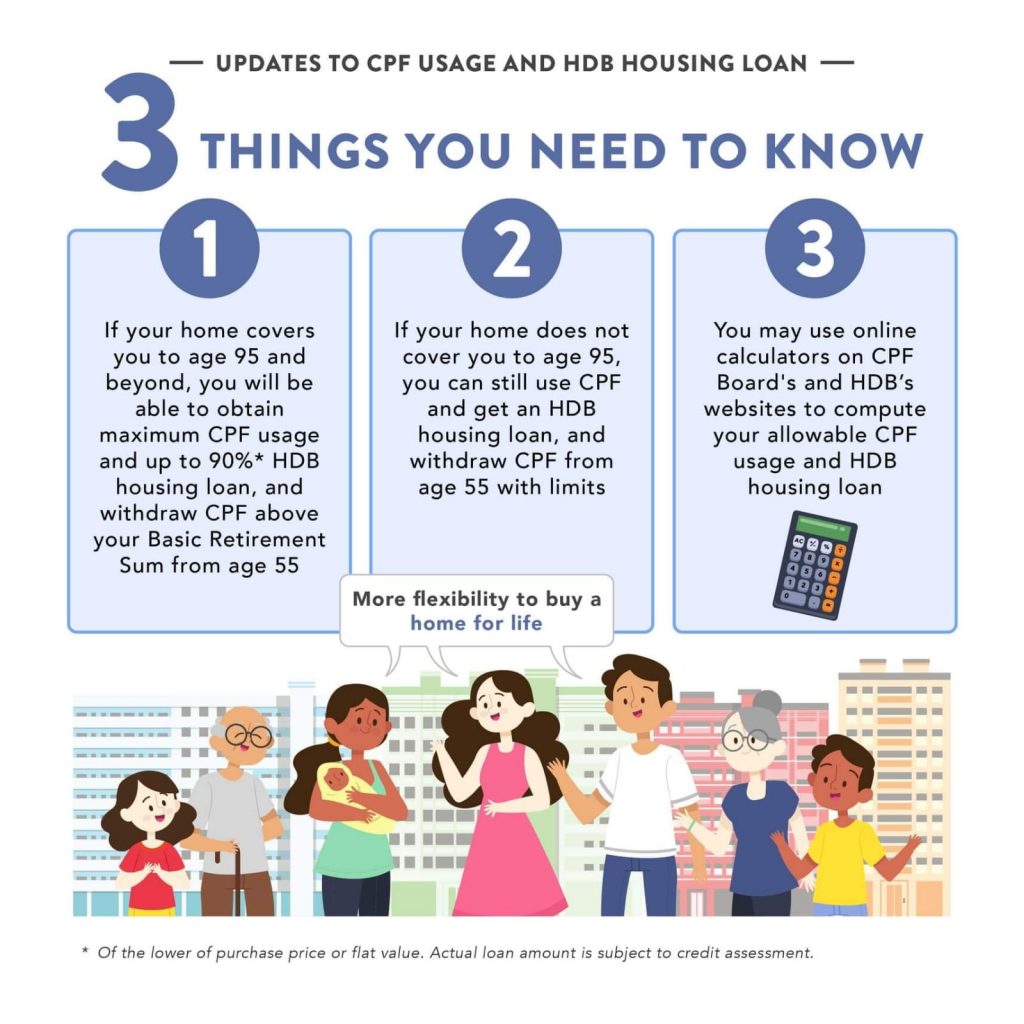

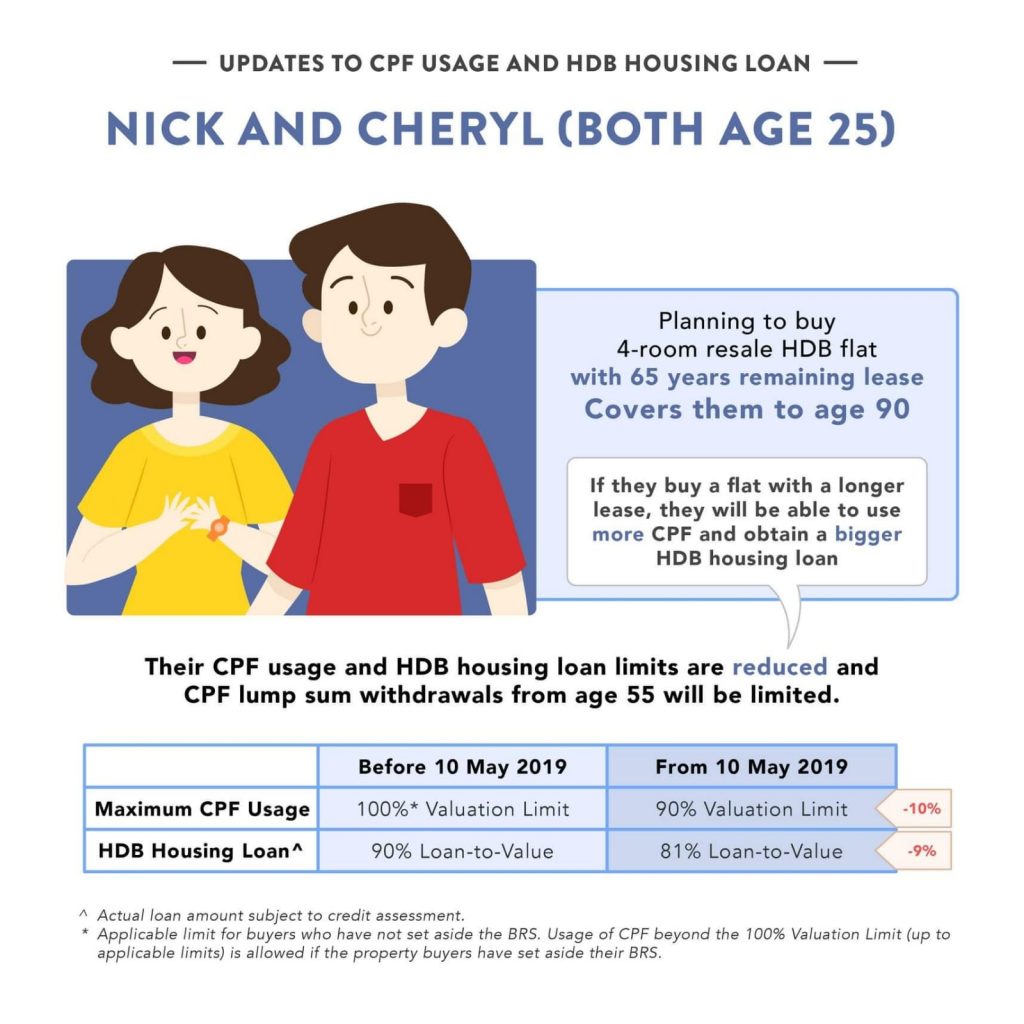

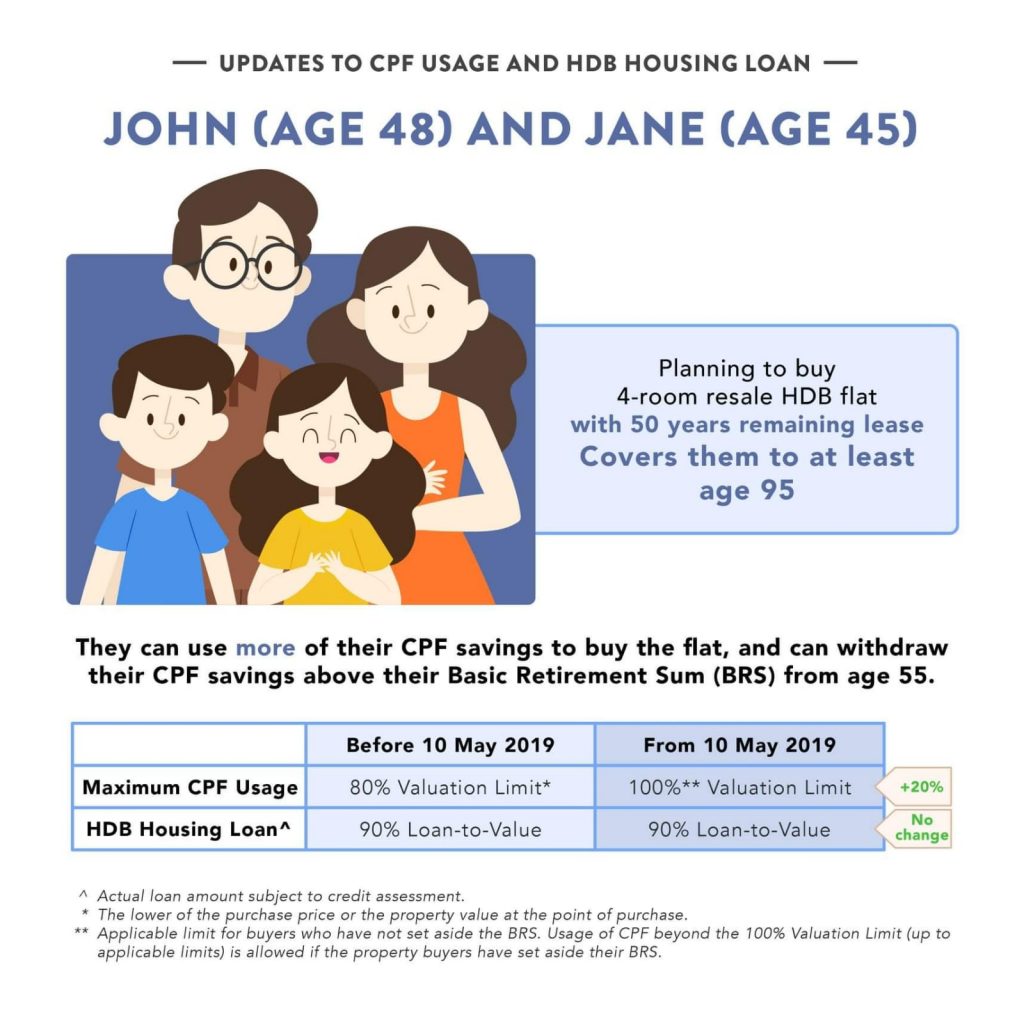

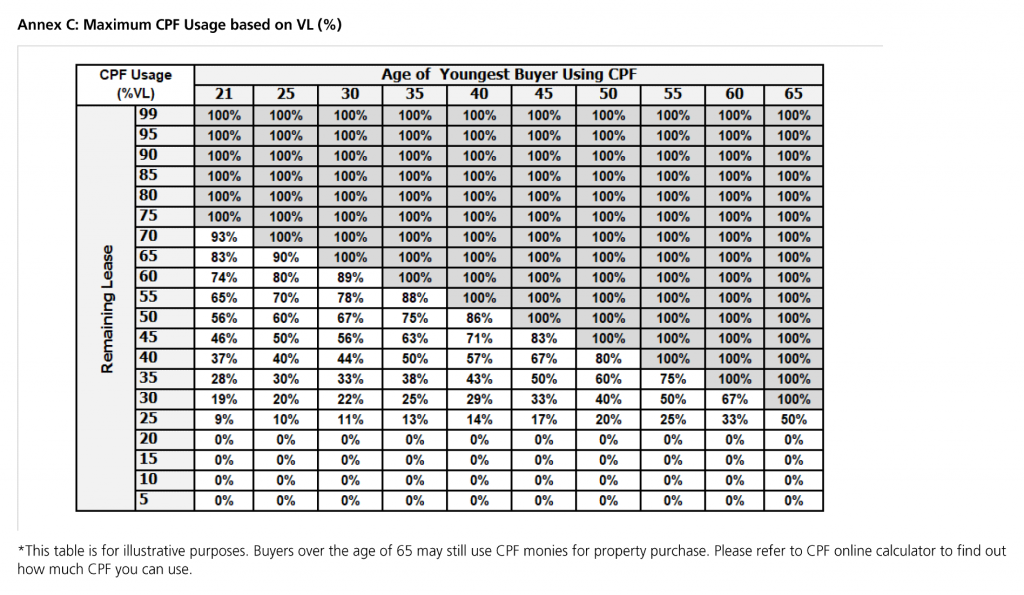

With effect from 10 May 2019, CPF usage will depend on whether the remaining lease can cover the youngest buyer until age 95.

>> If this criteria is met, a buyer can use CPF to pay for a property up to its valuation limit.

>> If not, the use of CPF will be pro-rated.

** No CPF can be used if the remaining lease is less than 20 years. This has been lowered from 30 years currently.

*All diagrams and illustrations are extracted from online sources.